公司简介

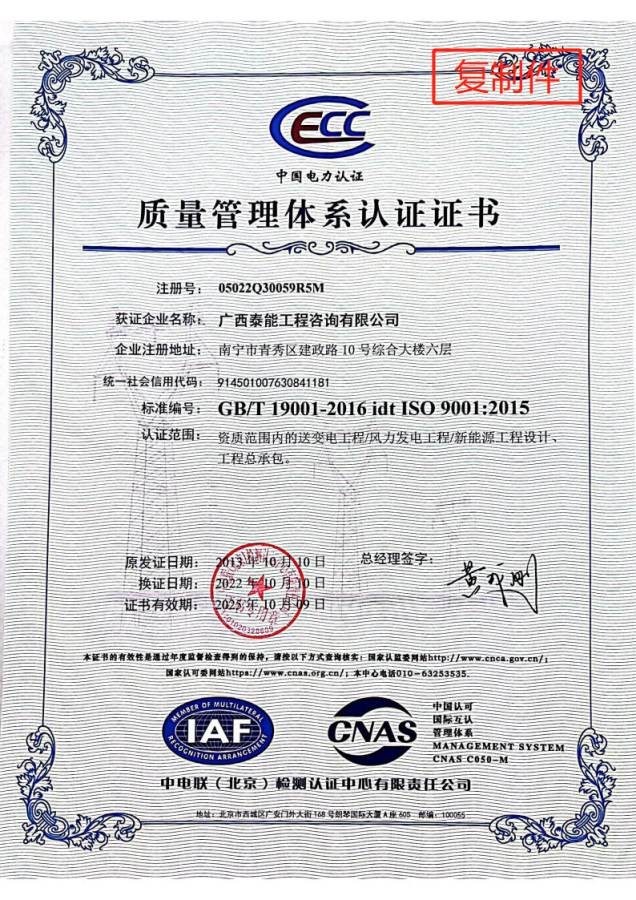

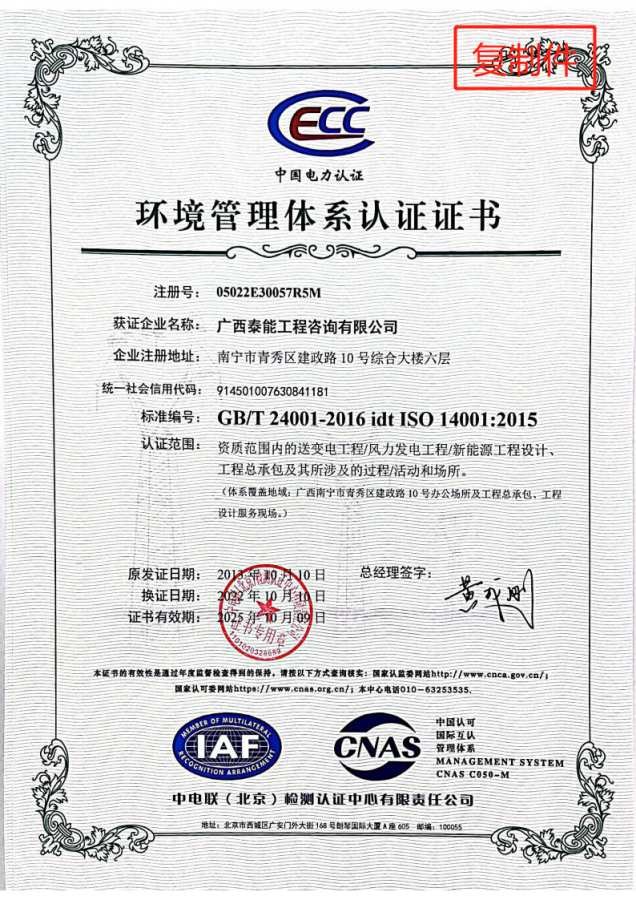

开云官方网站-开云kaiyun(中国)位于美丽的绿城——广西首府南宁市。公司成立于2004年7月,注册资本5000万元人民币,是具有独立法人资格的综合性专业咨询公司,为中国能源建设集团广西电力设计院有限公司的全资子公司。经国家权威认证机构审核,取得了GB/T19001:2016 idt ISO 9001:2015 质量管理体系、GB/T24001:2016 idt ISO 14001:2015 环境管理体系和GB/T28001-2011 idt OHSAS 18001:2007 职业健康安全管理体系认证...

更多

开云官方网站-开云kaiyun(中国)

- 喜讯:泰能公司多个项目获优质工程等奖项 2023-06-13

- 中节能忻城宿邓低风速试验风电场二期EPC总承包工程首台风机基础顺利完成浇筑 2023-02-24

- 泰能公司设计的110KV碧莲(龙城)送变电工程喜获中国电力优质工程奖 2022-06-28

- 泰能公司总承包项目平宣高速±800kV楚穗直流线路(1692#~1695#段)电力迁改工程顺利投运 2022-04-22

- 融安协合狮子岭风电场一期项目送出线路工程举行开工仪式 2021-07-30

- 泰能公司宿邓低风速试验风电场EPC总承包项目部开展“安全生产活动月”活动 2021-06-28

- 泰能公司赴广西崇左宁明桐棉风电场(50MW)送出线路工程总承包项目部现场进行安全检查 2021-06-08

- 南丹县生活垃圾焚烧发电项目环境影响评价公众参与第二次公示 2023-07-03

- 昭平县2018年项目农网改造升级工程(第一批)水土保持设施验收信息公示 2023-06-20

- 2017年农网改造升级工程昭平县10kV以下农网改造升级项目水土保持设施验收信息公示 2023-06-20

- 昭平县2018年农网改造升级工程(第三批)水土保持设施验收信息公示 2023-06-18

- 昭平县2018年农网改造升级工程(第二批)水土保持设施验收信息公示 2023-06-18

- 苍梧县新县城城西110kV送变电工程水土保持设施验收信息公示 2023-06-02

- 富川瑶族自治县水利电业有限公司调度综合大楼附属1#、2#楼工程水土保持设施验收信息公示 2023-06-02

更多

公告通知

联系我们

地址:广西南宁市建政路10号

电话:0771-5699427

传真:0771-5699428

电子邮箱:tn@gxed.com

开云官方网站-开云kaiyun(中国) © 2006 版权所有 | 技术支持:传导网络 桂ICP备12006011号-1 桂公网安备 45010302001887号